According the Tax Department’s “About Us” webpage, its education efforts are the “cornerstone of the State’s system of taxation” because it promotes “voluntary compliance.” According to the Department, “[m]ore than 96 percent of the taxes collected are remitted voluntarily by taxpayers.” And the necessary component of this high voluntary compliance rate is education. It is difficult for taxpayers to comply with a legal obligation they do not understand.

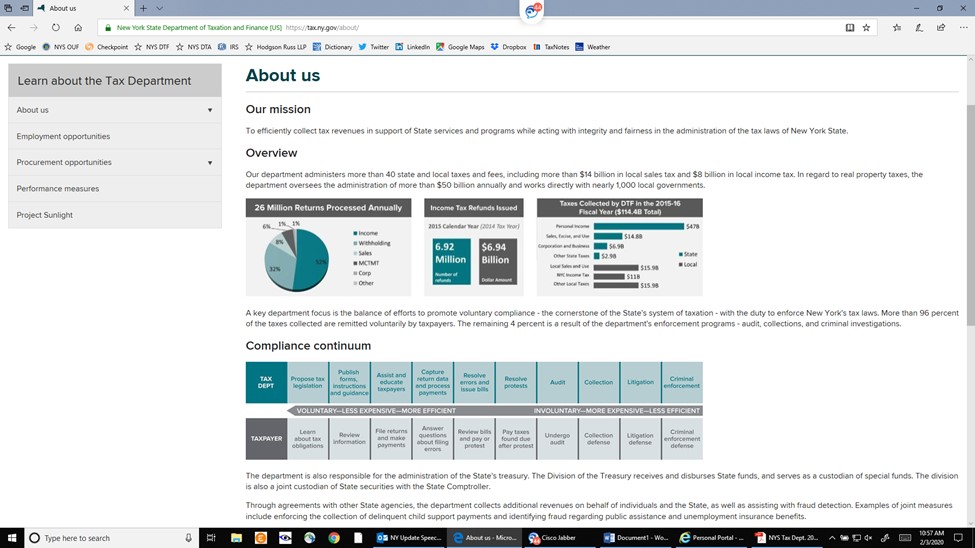

Moreover, the Tax Department acknowledges that “voluntary compliance” is much more efficient and less expensive than involuntary compliance (i.e., audits!). A copy of the Tax Department’s “Compliance continuum” (screenshot below) confirms that everything on left side of the chart is efficient, while everything on the right side is costly.

We’ve heard Tax Department representatives tout their desire to increase voluntary compliance in numerous public presentations. But given this publicly-stated goal of increasing voluntary compliance, and considering the fact that taxpayer education is a necessary component of this goal, it is a bit surprising that the Tax Department has virtually given up on issuing sales tax advisory opinions in recent years.

Advisory opinions are a particularly useful tool for taxpayers trying to comply with New York’s sales tax law. Taxpayers can petition the Tax Department to opine on how it believes the sales tax applies to a specific set of facts. These opinions are binding on the Tax Department with respect to the taxpayers who requested them so long as all material facts have been accurately provided by the taxpayer. And because the sales tax law is so fact-specific—the slightest change in the facts of a transaction can transform a nontaxable transaction into a taxable one—these opinions are particularly useful tools for applying the law to sales of new technologies and new structures. While amending the Tax Law or regulations to keep up with new technologies and structures can be time consuming and slow, these opinions give the Tax Department the ability to be much more responsive and nimble. And the sales tax demands this agility in a way that New York’s other taxes do not. Historically, sales tax advisory opinions comprised the majority of advisory opinions issued in a given year because of the myriad factual distinctions that can affect the application of the tax. Though it does not appear that the Tax Department publishes the number of advisory opinion requests it receives each year, I would be shocked if the number of sales-tax-related requests didn’t dwarf the number of requests for all the other taxes.

The problem here is that the amount of sales tax advisory opinions issued by the Tax Department has been diminishing precipitously over the past several years. Take a look at the chart below:

|

Year |

No. of SUT AOs Issued |

|

2019 |

1 |

|

2018 |

5 |

|

2017 |

23 |

|

2016 |

34 |

|

2015 |

53 |

I can appreciate that the Tax Department has limited resources and we applaud the fact that among the state tax authorities, it certainly publishes more guidance than most (some states don’t even have a formal means to petition for guidance). But this rate of decline in sales tax opinions is alarming. Moreover, the amount of time it takes to receive an advisory opinion these days makes them effectively useless. We previously wrote about this here. Based on our experience and anecdotal information from other taxpayers and practitioners, we’ve been telling taxpayer that are considering getting a sales tax advisory opinion that they better be willing to wait for two to three years. Even with New York’s generous voluntary disclosure program, this incubation period typically proves untenable for most taxpayers.

Unfortunately the stakes for getting sales tax compliance wrong are grave either way: if a business doesn’t charge tax but should have, it is liable for the unpaid tax, interest and possible penalties (this includes personal liability for those running the business). And if it charges sales tax but shouldn’t have, it is vulnerable to class action “overcollection” lawsuits brought by its customers. This was a significant concern for one of the largest technology retailers in a recent case.

So consider this post to be a plea to the powers-that-be to increase the resources available to the Tax Department for sales tax advisory opinions. These opinions are particularly vital to sales tax voluntary compliance (much moreso that for other taxes). We whole-heartedly support the allocation of some additional revenue to hire a few more attorneys in the Tax Department’s Office of Counsel to help churn out more advisory opinions.

The students are here. We’re waiting for the master to (re)appear.